Tokenization on the Blockchain using Smart Contracts to authenticate digital ownership.

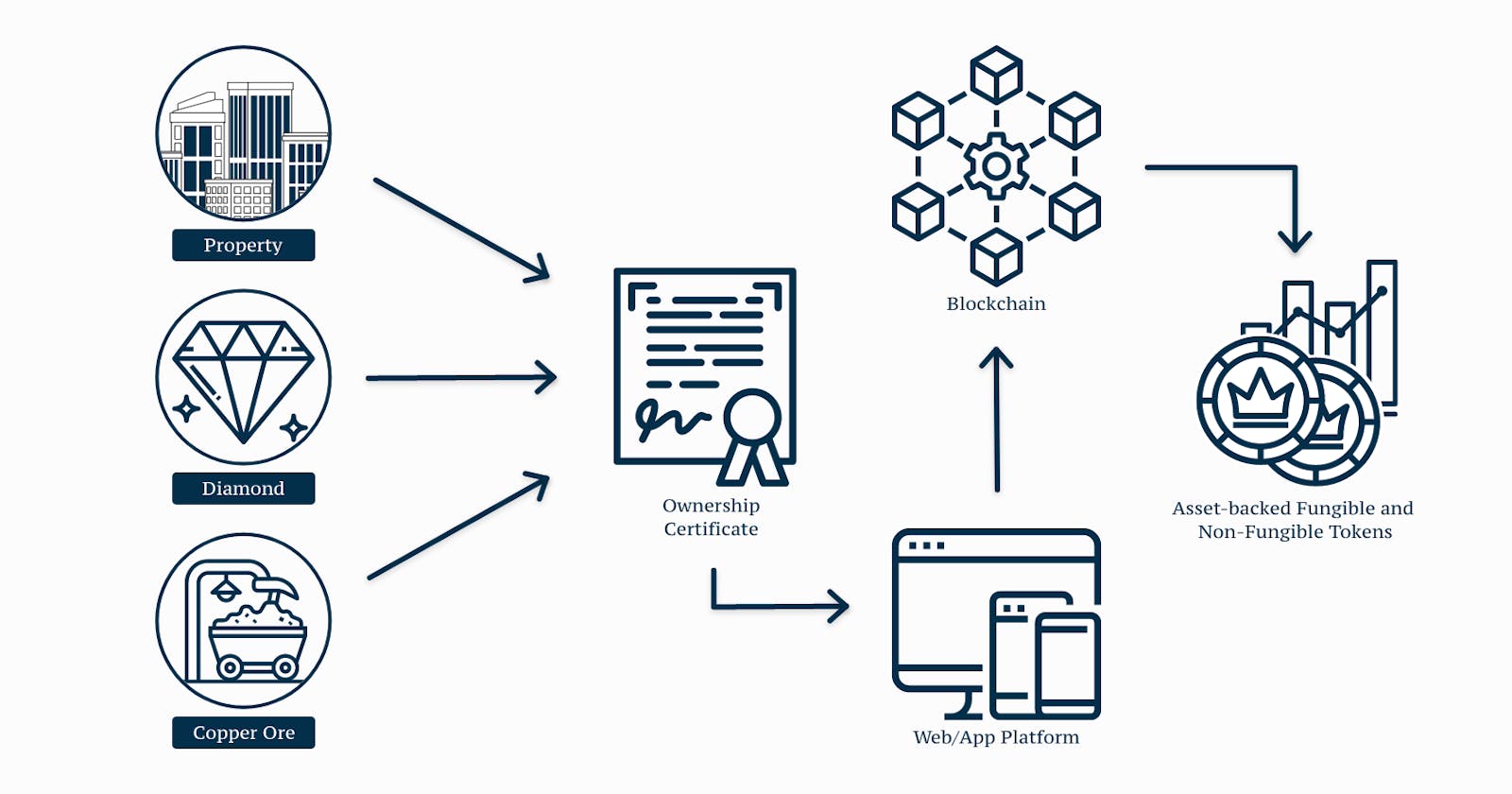

Tokenization is the process of representing a real-world asset as a digital token on a blockchain. This allows the asset to be securely tracked and transferred on the blockchain, with the added benefit of increased liquidity, as the asset can be traded or exchanged for other digital assets. Blockchain technology, along with the use of smart contracts, has enabled the tokenization of a wide array of digital assets, including real estate, commodities, and even art.

Tokenization on the blockchain is the process of representing a real-world asset as a digital token on a blockchain. This allows the asset to be securely tracked and transferred on the blockchain, with the added benefit of increased liquidity, as the asset can be traded or exchanged for other digital assets. This process is often used to tokenize traditional financial assets such as stocks and bonds and non-fungible assets such as real estate and art.

The use of blockchain technology and smart contracts makes it possible to tokenize digital assets securely and efficiently. By leveraging the power of the blockchain, tokenization can provide a secure and reliable way to transfer ownership of digital assets. Tokenization also has the added benefit of increased liquidity, as the asset can be traded or exchanged for other digital assets.

Smart contracts are an integral part of tokenization on blockchain. Smart contracts are computer protocols that are used to facilitate, verify, and enforce the terms of a contract. Smart contracts can automate the transfer of digital assets, allowing for the secure and efficient transfer of ownership. Smart contracts can also be used to verify ownership of digital assets, providing a layer of security and trust.

Tokenization on the blockchain is a powerful tool for digital asset ownership and transfer. By using blockchain technology and smart contracts, tokenization can provide a secure and efficient way to transfer ownership of digital assets. This can also increase liquidity, as the asset can be traded or exchanged for other digital assets.

Examples of digital assets that can be tokenized

Real estate: Real estate can be tokenized, allowing an owner to tokenize their property and trade it as a digital asset.

Commodities: Commodities such as gold, silver, oil, and other precious metals can be tokenized, allowing them to be traded and exchanged as digital assets.

Art: Artwork such as paintings and sculptures can be tokenized, allowing them to be securely tracked and transferred on the blockchain.

Stocks and bonds: Stocks and bonds can be tokenized, allowing them to be securely tracked and transferred on the blockchain.

Cryptocurrencies: Cryptocurrencies such as Bitcoin and Ethereum can be tokenized, allowing them to be securely tracked and transferred on the blockchain.